1701q Deadline 2024 2nd Quarter

1701q Deadline 2024 2nd Quarter. The same shall be reported in the annual income tax return. 1701q 1st quarter 2024 + 2551q:

Learn how to file the quarter income tax return for non vat taxpayers using bir form 1701q. For those availing the graduated.

1701q Deadline 2024 2nd Quarter Images References :

Source: sheribmarcia.pages.dev

Source: sheribmarcia.pages.dev

1701q Deadline 2024 2nd Quarter 2024 Lacie Miquela, Below is a guide if you follow calendar year accounting period:first quarter covering.

Source: www.kailasharlene.com

Source: www.kailasharlene.com

BIRform1701Q 2nd quarter Kaila Sharlene, Make timely tax payments with this guide!

Source: www.youtube.com

Source: www.youtube.com

How to file Quarterly ITR 1701Q through eBirforms? YouTube, On or before april 15 of the current taxable year.

Source: www.youtube.com

Source: www.youtube.com

How to File 1701Q Graduated IT Rate (OSD) for 2nd Quarter YouTube, *there is no quarterly income tax return (1701q/1702q) for the 4th quarter of the year.

Source: sheribmarcia.pages.dev

Source: sheribmarcia.pages.dev

1701q Deadline 2024 2nd Quarter 2024 Lacie Miquela, Okay, so what is bir form 1701q?

Source: www.youtube.com

Source: www.youtube.com

HOW TO FILE FILL UP 1701Q QUARTERLY TAX 2ND QTR NON VAT 2022, Bir form 1701q must be filed every first to third quarter of each year.

Source: bir-1701q-form.pdffiller.com

Source: bir-1701q-form.pdffiller.com

Bir Form 1701q Excel Format Download Fill Online, Printable, Fillable, Forecasts your future 1701q tax dues, so you can budget.

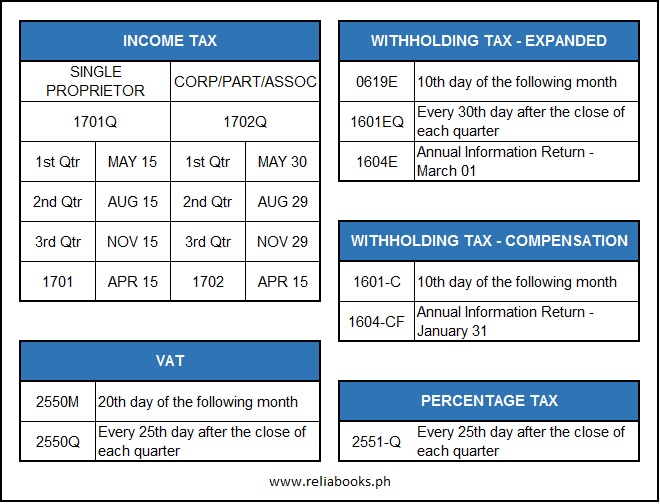

Source: reliabooks.ph

Source: reliabooks.ph

Important Dates to Remember for Philippine Businesses, Learn how to file the quarter income tax return for non vat taxpayers using bir form 1701q.

Source: www.youtube.com

Source: www.youtube.com

Deadlines of your quarter and annual tax returns / BIR form, Make timely tax payments with this guide!

Source: www.youtube.com

Source: www.youtube.com

HOW TO FILL OUT 1701Q QUARTERLY TAX RETURN EBIR FORM 2022 YouTube, Learn how to file the quarter income tax return for non vat taxpayers using bir form 1701q.

Posted in 2024